by David Repka

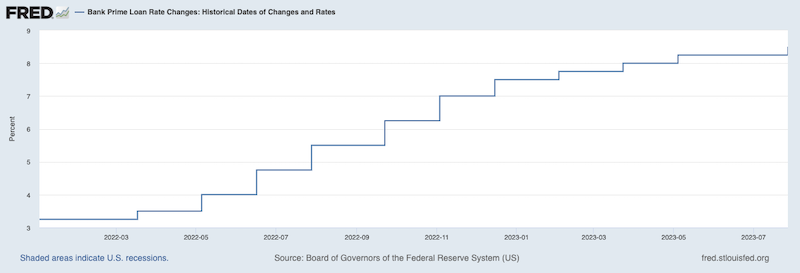

Prime Rate has risen from 3.25% in January 2022 to 8.5%. What problems does this create for commercial real estate investors? And what steps should be taken?

- Rising Cost of Borrowing: With Prime interest rate nearly tripling, the cost of borrowing for commercial real estate investors with floating rate loans has significantly increased. This can impact an investor’s ability to finance new acquisitions and refinance existing properties at favorable terms. Can new fixed rate debt be arranged? Is there a gap that needs to be filled with equity?

- Reduced Investment Returns: Higher interest rates can lead to reduced investment returns for commercial real estate projects. As financing costs rise, investors may experience lower cash flows and overall profitability. Is it time to triage the portfolio and sell underperforming assets to bring cash into the deals worth saving?

- Impact on Property Valuations: Rising interest rates can influence property valuations. As the cost of borrowing increases, property values may be negatively affected, potentially leading to lower appraisals and impacting investors' equity positions. It is time for borrowers and their professionals to re-read the loan documents. Can the lender force loan curtailment if the appraised value dips? Does the borrower have access to equity to pay down principal to bring the loan back into “balance”?

- Slower Deal Activity: The higher cost of financing may deter some investors from entering the market, leading to decreased deal activity and potentially reducing liquidity. Professional investors are currently raising equity at an astonishing rate to have dry powder available to acquire assets from distressed sellers at an attractive basis. Gone are the days of a national broker sending out a teaser email to a 10,000 person database to get 100 investors to sign a CA, 80 investors to do a property tour, 30 investors to write contracts, and one “lucky” investor getting the ability to buy it after three “best and final” rounds.

- Refinancing Challenges: Commercial real estate investors with existing loans may face challenges when it comes to refinancing. Higher interest rates could limit their ability to secure new loans with favorable terms, leading to potential cash flow issues and increased default risks. Borrowers may need to sell or bring in a new layer of equity capital. Discretionary refinances have mostly evaporated. The author of this article has been reaching out to owners of properties with a tremendous equity position to refinance in order to build a war chest for future acquisitions as properties owned by those with weak hands will need to fold in order to have any hope of preserving their capital.

6. Stricter Lending Standards: Lenders have tightened their underwriting standards in response to rising interest rates and potential market uncertainties, making it harder for investors to qualify for loans. Many lenders are virtually ignoring Loan to Value as an underwriting ratio since value is so hard to determine right now. Lenders are fixated on a property’s Debt Coverage Ratio.

7. Impact on Development Projects: Higher interest rates can impact the feasibility of new development projects. Developers now face higher construction financing costs, leading to delays or cancellations of projects. Equity requirements have risen from 20 to 25% to 45 to 55%. A bright spot remains the development of Single Tenant Net Lease (STNL) properties where leverage of up to 100% LTC is still available for well qualified developers and strong tenants. The other bright spot is large, ground-up multifamily projects (all-in cost of $80+ million) in locations showing stong market demand. Fixed-rate leverage is available at up to 70% of cost on a non-recourse basis.

8. Potential Bubble Concerns: Rapidly rising interest rates may raise concerns about a commercial real estate bubble, leading to investor caution and increased scrutiny on market fundamentals. The STNL market continues to thrive as it is driven by tax sensitive 1031 investors looking to defer capital gains taxes.

9. Market Volatility: The sudden increase in interest rates can introduce volatility in the commercial real estate market, as investors grapple with uncertainty and adapt to changing economic conditions. When there is uncertainty, the natural response is to go into “asset management mode” focused on the existing portfolio and ignoring new opportunities. The author worked with a multi-generational Billionaire Family Office early in his career that classically said of the real estate crash of the late 1980s-early 1990s, “sometimes you just gotta go to the beach, put your feet up and drink Pina Coladas until the market gets better”. The author has found pickleball to be an excellent escape from market volatility.

10. Risk of Loan Defaults: Commercial real estate investors with variable-rate loans may face increased risks of default as interest payments rise, particularly if they are unable to generate sufficient rental income to cover expenses. Depending on the lender profile this can end up in an all out war, or calmer heads will prevail and a negotiated solution can be achieved.

In conclusion, the near tripling of interest rates in the last 18 months has introduced several challenges for commercial real estate investors, affecting their financing costs, returns, deal activity, and overall market dynamics.

It's essential to closely monitor these developments and their potential implications for the broader economy, financial markets, and your financial prosperity.

Click to learn more about:

Bison Financial Group