Liquidity has Returned to Capital Markets

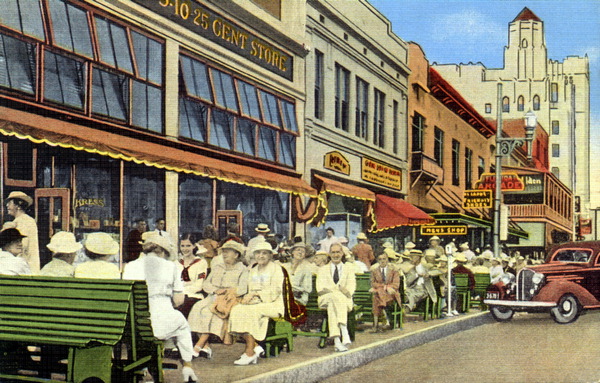

The commercial real estate capital markets have recovered from the dark days of the global financial crisis bringing liquidity to Main Street, USA. Large balance loans delivering $25+ million to institutional and well-heeled private investors were the first market to recover.

Over the last 12 months the small balance market serving-up loans from $1 to $10 million has exploded flooding the market with liquidity.

While the borrowing rules are different from the go-go days of 2005-2006 capital has returned to Main Street!

Details on Small Balance Loans:

Loan Size: $1-10 million

Loan Term: Borrowers can choose from various loan terms. 5-7-10 years are the most popular

Amortization: 25 or 30 years with interest-only periods ranging from 1 year to full term of 10 years depending on leverage

Rates: Starting in the 4s and going to the 6s

Leverage: Max leverage of 75-80% depending on property type and debt coverage. Low leverage loans under 65% LTV receive the best pricing. Senior debt plus mezzanine structures available up to 85% LTV

Recourse: Non-Recourse with carve-outs for "Bad Boy" acts

Collateral type: Multifamily rental apartments, retail, office, warehouse, industrial, flex, self-storage, hotels, and single tenant net leased properties

Collateral type NOT considered: Non-income producing properties including land and liquidating assets such as residential for-sale subdivisions and condo projects

Gain access to these programs for your next project:

Contact David Repka or send e-mail to moc.laicnanifnosibnull@evad, and provide 8 to 10 bullet points on the opportunity.

Before you go, save some time by browsing our Sample Executive Summary and Loan Checklist and look for the downloadable PDFs.