by Jared Repka Bison Financial Group principal, David Repka, was recently interviewed by a national commercial real estate publication to discuss his views on where the single-family residential lending market is headed in 2021…. Q: What are your predictions for single-family rental lending going forward? David Repka: I have been active in the commercial real Read More

Posts by admin

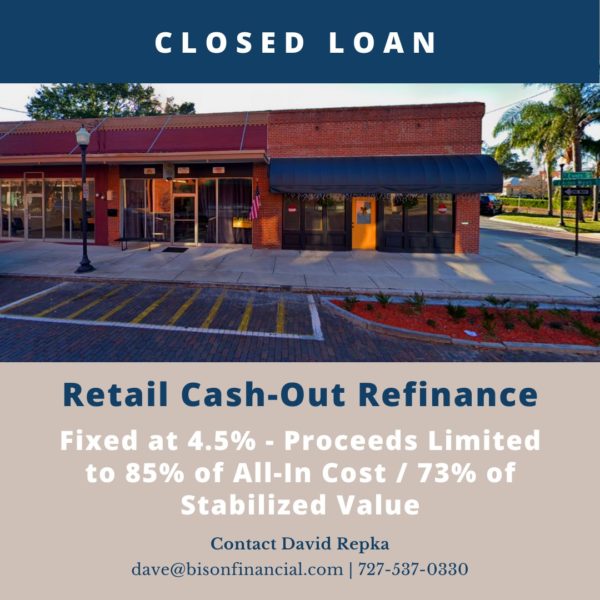

Bison Closes Retail Cash-Out Refinance Fixed at 4.5%

by David Repka Bison announces a recent closing and funding for a local retail property. Overview: $1 million refinance loan fixed at 4.5% Proceeds limited to 85% of all-in cost / 73% of stabilized value Enabled the ownership group to retire the acquisition loan and out of pocket costs incurred to refurbish the property Read More

Bison Closes 6th STNL Construction Loan at 95% LTC

by David Repka Bison announces their 6th closing and funding of a high-octane credit facility for a developer of single tenant net leased properties. Overview: Have more projects than capital? Bison Financial Group just closed its 6th deal in past 22 months with an investor that funds up to 100% of cost (95% this Read More

Bison Discusses What to Expect for the Manufactured Housing Sector in 2021

by Jared Repka Bison Financial Group principal, David Repka, was recently interviewed by a national commercial real estate publication to discuss his views on where the Manufactured Housing Market is headed in 2021…. Q: What are your predictions for manufactured housing community (MHC) lending going forward? A: Manufactured housing communities in all their iterations are Read More

Bison Closes $4.82 Million Acquisition Loan for Hotel to Multifamily Conversion

by David Repka Bison announces their 2nd closing and funding for a local family that invests in turnaround properties. Overview: $4.82 million acquisition loan Hotel to multifamily conversion loan to acquire an underutilized property in Downtown Tampa, Florida In mid-2020 Bison closed a cash-out refi loan for the Sponsor at a fixed rate of Read More

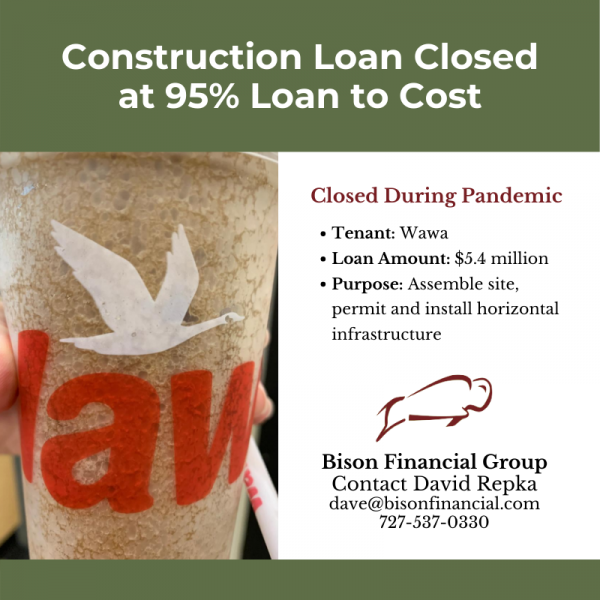

Bison Closes STNL Construction Loan for 95% of Project Cost

by David Repka Bison announces their 5th closing and funding of a high-octane credit facility for a developer of single tenant net leased properties. Overview: Have more projects than capital? Bison Financial Group just closed its 5th deal since 2019 with an investor that funds up to 100% of cost Proud to mention that Read More

Bison Discusses What to Expect for the Retail Financing Sector in 2021

by Jared Repka Bison Financial Group principal, David Repka, was recently interviewed by a national commercial real estate publication to discuss his views on where the Retail Financing Market is headed in 2021…. Q: What are your predictions for retail financing going forward? For 2021? A: The Covid-19 crisis has accelerated the retail transition that Read More

Bison Closes Construction Loan for 95% of Project Cost

by David Repka Bison announces their 4th closing and funding of a high-octane credit facility for a developer of single tenant net leased properties. Overview: Have more projects than capital? Bison Financial Group just closed its 4th deal since 2019 with an investor that funds up to 100% of cost Proud to mention that Read More

Bison Discusses What to Expect for Single Family Rental Lending Sector in 2020

by Jared Repka Bison Financial Group principal, David Repka, was recently interviewed by a national commercial real estate publication to discuss his views on where the Single Family Rental Financing Sector is headed for the remainder of 2020…. Q: What are your predictions for single-family rental lending going forward? David Repka: Tremendous amount of interest Read More

Bison Closes Massive Cash-Out Refi

by David Repka Bison announces the closing and funding of a massive cash-out refinance on a 2.5 star mobile home park on Florida’s West Coast. Overview: 2.5 star family mobile home park $10.92 million loan pays off loan balance <$1 mm for massive cash-out 10 years IO Fixed-rate of 2.89% Non-Recourse subject to bad-boy Read More