By David Repka

What is “Promotable Preferred Equity”?

Short answer: it is how real estate developers get rich!

Long answer:

It is a way that real estate developers earn entrepreneurial profits above and beyond the returns generated from their direct capital contributions. First, let’s clarify some terms. The term “developer” is commonly used in commercial real estate to describe the entrepreneur focused on new construction or value-added opportunities. For the purpose of this article “developer” is interchangeable with the term “project sponsor” for the entrepreneur that organizes an investment syndicate for less construction intensive opportunities. This is the person or company that is the key driver of the opportunity and responsible for leading the charge. They orchestrate the deal from beginning to end and their job is to:

- source the investment opportunity

- obtain site control /get it under contract

- build the team that will execute on their vision / the business plan

- evaluate / due diligence the asset

- execute the financing plan (arrange senior debt, mezzanine, equity, etc.)

- oversee the value creation process (true whether this is a turnaround or new construction)

- design, implement and oversee the leasing, sales and management plan

- communicate with investors / provide reports and share tax filing documents

- harvest the asset / sell it!

A developer using 100% of their own funds for the entire capital stack is rare. A more common scenario is a developer that is using various tranches of other people’s money (OPM). There are several components to the capital stack where passive investors can participate with experienced developers including:

- senior debt

- mezzanine debt / preferred equity

- pari passu equity

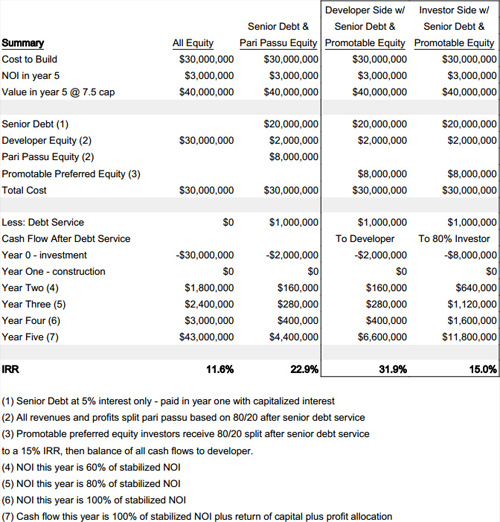

It is through the strategic use of OPM that developers get rich. Let’s walk through a real-life example. Let’s take the case of a to-be-built ALF with a $30 million cost. Let’s assume the developer has negotiated an advantageous purchase of the land and has projected a NOI at stabilization of $3 million for an unlevered profit on cost (return on cost / unlevered return on investment) of 10%. We will also assume that the value at stabilization can be determined by applying a 7.5 cap rate resulting in a value of $40,000,000. Here is how the numbers work out for the developer based on three scenarios:

- all cash (no leverage of any kind)

- pari passu equity (returns split based on cash contribution with no “promote” or “investment waterfall” of any kind)

- promotable preferred equity in which cash flows are initially split based on capital contributions then shift based on the project generating certain profit levels and the developers share of the cash flow and profits going up as the project becomes more and more profitable

An analysis of the spreadsheet indicates the following:

The All Equity Scenario results in the lowest yield. In this case the developer invests $30 million, earns unlevered returns in years two thru five and sells the property for $40 million in year five for an IRR of 11.6%.

In the Pari Passu scenario the developer fares better because they benefit from low cost leverage of only 5%. The low cost leverage boosts their return to 22.9% IRR.

The magic happens in the third scenario. Because the developer was able to find an investor that would agree to cap their return at a 15% IRR all the additional profits flow to the developer. After paying senior debt and the investor’s IRR hurdle of 15% all entrepreneurial profits flow to the developer. While they made the same investment as in the Pari Passu case they earned a promotional return above and beyond the ratio that their capital provided. In summary, this is how developers get rich! (Note: a special thanks to my friend, commercial mortgage banking legend, George Blackburne, who inspired me to write this article as a follow up to an article he wrote on this topic!)

Follow this link for a complimentary, instant download of our latest white paper: What capital raising secret do the mega developers know that you don’t? This report provides an analysis of how some of the largest real estate developers in the country are utilizing a very specific and little understood type of OPM to enhance their fortunes.