By Jared Repka

‘A’ is for Apartments.

‘B’ is for Buy Them Now.

‘C’ is for Cheap Money.

It’s time to dust off the old school books and remember our lessons from nearly half a lifetime ago; that buying multifamily apartment communities is a very wise long-term investment that can bring significant appreciation to your overall asset portfolio. You’ve heard the saying many times before…. ‘people must have a place to live’. Truer words have never been spoken and with the nail biting corrections in the stock market of late, wouldn’t it be nice to sleep well at night knowing that what happens in China or Germany isn’t going to bring some knee-jerk reaction that could affect your net worth in an instant?

Here’s a 3-month chart of the Dow courtesy of Yahoo Finance. It’s like we’re at Cedar Point riding the roller coasters until we puke!

We’ve found the ride much smoother for our clients who invest in the right income producing multifamily properties in the right locations while utilizing strong management principles. Multifamily properties offer the following advantages to an investor:

- Dependable income stream based on seven to twelve month leases

- Hedge against inflation: when inflation occurs, the price of real estate, particularly multi-tenant assets will also rise

- Physical asset value of the land and structures: mulitfamily real estate investments do not have negative and positive days as does the stock market

- Asset value appreciation: multifamily investments have historically provided excellent appreciation in value that meet and exceed other investment types. Properties historically increase in value as the net operating income of the property improves through rent increases and more effective management of the asset

- Tax benefits of the US Tax code assist multifamily real estate owners in a number of ways including mortgage interest deductions and depreciation accelerations that can shield a portion of the positive cash flow generate. At the time of sale, the IRS allows multifamily investors a 1031 provision, allowing you to exchange into a like kind instrument and defer all taxable gains into the future (speak to your accounting professional)

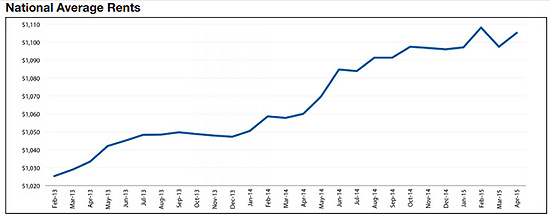

Here’s a 3-year chart of national average multifamily rents. Smooth and steady.

To complete this month’s lesson on why to consider investing in multifamily real estate we need to look no further than ‘C’…. Cheap money!

Borrowing rates on multifamily real estate are at or near historic lows with incredible flexibility available on structure and terms. Placing “positive leverage” on an asset allows for our clients to effectively increase positive cash flow from operations by borrowing money at a lower cost than the property pays out. This is how you build true wealth.

The debt on the property will be reduced by the income of the property’s net operating income or NOI. NOI is determined by the gross income less all expenses before debt; the NOI will sufficiently fund the debt payments thereby reducing the debt balance and creating equity.

Once a multifamily asset is stabilized the real fun begins with the ability to place long-term, fixed rate debt on the asset several times the original equity allowing our clients to buy more assets with less money and thus significantly multiply asset values. Then we rinse and repeat, growing our clients multifamily portfolio one property at a time and producing multigenerational wealth.

Bison Financial Group is an advisory firm based in St. Petersburg, Florida connecting people, opportunities and capital. Our clients are entrepreneurs focused on creating long-term income streams by investing in commercial real estate and renewable energy projects. The principals of Bison have a track record of participating in over $1 billion in transactions since being founded in 1994 by brothers David and Jared Repka.