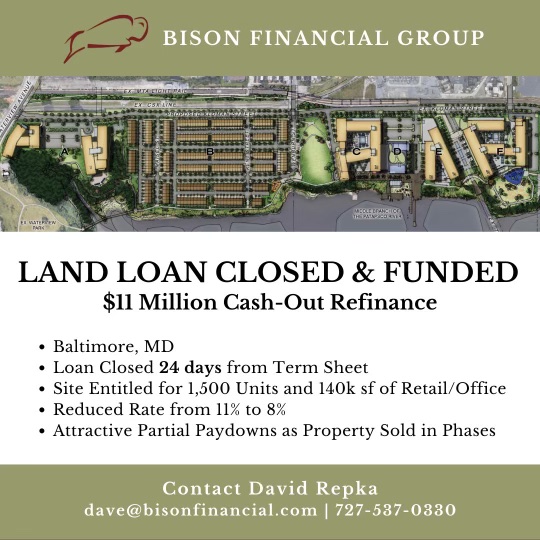

by David Repka Bison announces the closing and funding of a land loan on the waterfront in Baltimore, MD Overview: $11 million refinance loan closed in 24 days from executed Term Sheet Cash-out refinance for entitled land for 1,500 Read More

Tag: CMBS

Bison Closes $1.4 Million Cash-Out Refi and Acquisition

by David Repka Bison announces the closing and funding of loans secured by a portfolio of rental properties in the Charlotte, North Carolina MSA Overview: $1.4 million refinance and acquisition loan closed in 33 days Cash-out refinance of an Read More

Bison Closes $6.6 Million Modification and Expansion Loan for Multifamily

by David Repka Bison announces the closing and funding of a modification and expansion loan for $6.6 million on a familiar property in Downtown Tampa, Florida Overview: $6.6 million modification and expansion loan Client to acquire neighboring properties to increase Read More

Bison Closes $32 Million Construction Loan for 100% of Cost

by David Repka Bison announces the closing and funding of a $32 million loan for a developer of single tenant net leased properties at 100+% of cost. Overview: Tenants include Wawa, McDonalds, 76 Gas-Convenience Store, and Arby’s The loan Read More

Bison Closes $28.55 Million Perm Loan on Rental Portfolio

by David Repka Bison announces the closing and funding of a permanent cash-out refinance loan. Overview: $28.55 million non-recourse loan Portfolio of 304 single-family rental and apartment units over 182 properties Repeat borrower and 6th closing with lender Have Read More

Bison Closes $11.5 Million Loan on Covered Land Play

by David Repka Bison announces the closing and funding of a covered land play refinance loan. Overview: $11.5 million loan on a 3-year term Rate of 6% with 24-months Interest Only Recourse on only $1 million Have a deal Read More

Bison Closes $4.6 Million Refi Loan for AL MC Senior-Care Facility

by David Repka Bison announces the closing and funding of an Adult Living, Memory Care Senior Housing Facility refinance loan. Overview: $4.641 million loan Rate of 2.85% fixed for 35 years Non-recourse, no balloon, fully amortizing Property located in a Read More

Bison Closes $4.4 Million Acquisition Loan for Adult-Care Facility

by David Repka Bison announces the closing and funding of an SBA 7(a) acquisition loan for an Upstate NY Adult-Care Facility. Overview: $4,429,000 SBA 7(a) acquisition loan Fixed rate 10-year term Bison negotiated to allow for a seller held Read More

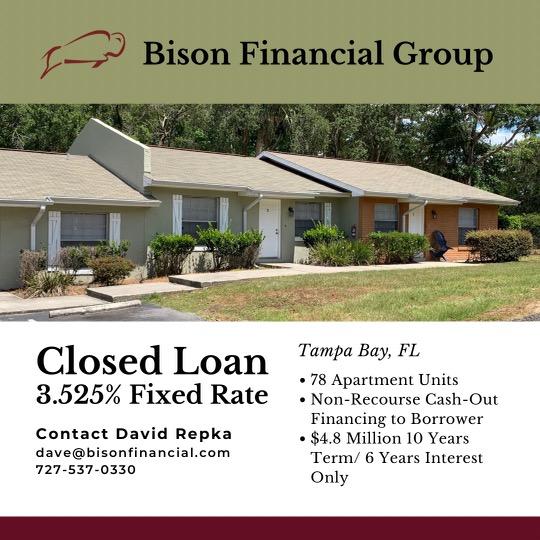

Bison Closes $4.8 Million Refi Loan for Class C Multifamily

by David Repka Bison announces another closing and funding for a longtime client that invests in turnaround properties. Overview: $4.8 million refinance loan Non-recourse, cash-out with 6 years of interest-only payments Workforce housing property that was recently acquired, rehabbed, Read More

Bison Closes $1 Million Working Capital Line of Credit

by David Repka Bison announces the closing and funding of a working capital line of credit. Overview: $1 million LOC fixed at 6% No real estate collateral required (that’s amazing!) Enabled a local, fast growing pest control company the Read More