ST. PETERSBURG, FL - Bison Financial Group headquartered here launches their ambitious "Nexus Funding Platform" aimed at bringing liquidity to the commercial real estate market and bringing jobs back to our communities.

According to David Repka, Co-Founder of Bison;

"During the recession of 2008-2015 we witnessed a level of economic devastation not seen since the Great Depression. People are unemployed or underemployed and investment capital is scarce due to the fear, uncertainty and doubt for an economic recovery. As we survey the wreckage dotting the financial landscape one area of limitless opportunities smacked us in the head: creating a reliable source of construction financing.

The void created by the implosion of so many national construction lenders forced us to craft an out-of-the-box solution to fill the capital gap. What we've created is the proprietary Nexus Funding Platform."

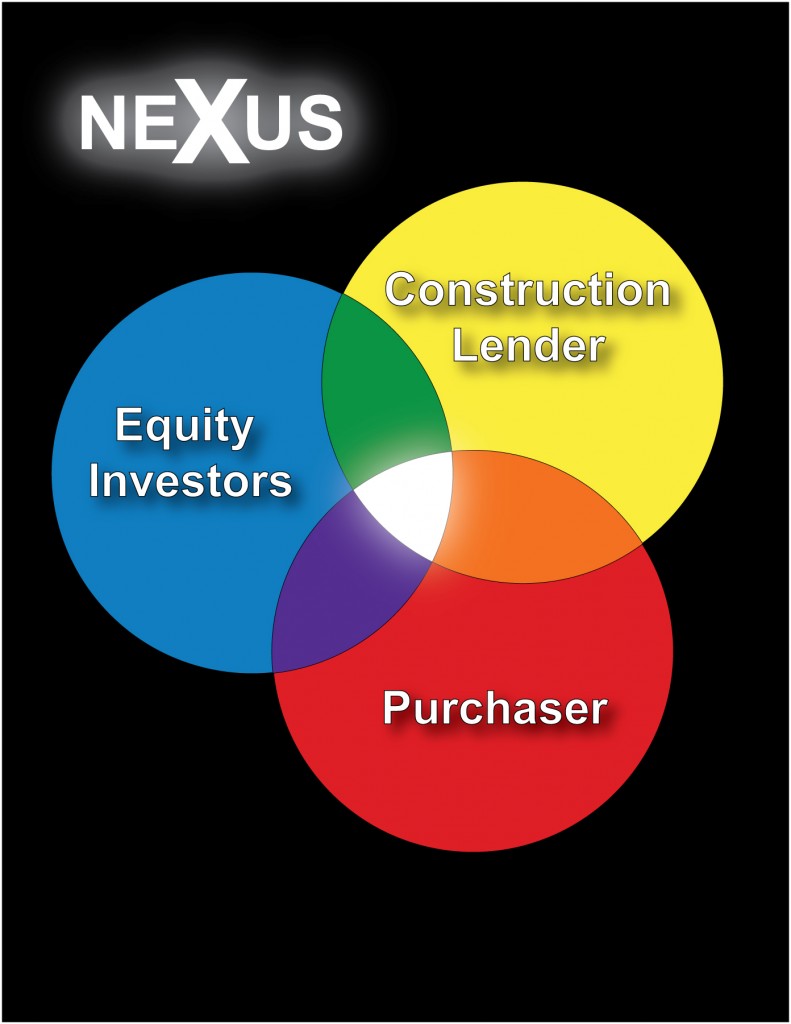

Since a nexus is a "connected series or group" Bison realized that the traditional merchant builder structure that has been used for decades needed to change with the times. A deeper collaboration among the deal participants needed to emerge to solve the problem and create thousands of construction jobs that our economy needs. The Nexus Platform combines:

- Investor Equity

- Construction Funding

- Sale of the Asset to a Long-Term Investor

.... into one logical transaction. Bison started by understanding the risk / return profile of its investors and then working backwards to design an investment vehicle that met the financial needs of their investors while reducing risk along the development path. By starting out with the needs of the long-term investor in mind Bison crafts transactions that work for them.

The process can best be described in an image:

The focus of the Nexus Funding Platform is on the investment needs of the ultimate Purchaser seeking an alternative to buying 10-year Treasuries that yield 2%. Opportunities are crafted in the Nexus Platform to take maximum advantage of their abundant capital and mitigate their risk at every step of the way.

According to Repka, "The best risk adjusted way to achieve compelling returns is to take some development & construction risk."

Significant cost savings can be achieved by combining into one nexus what has been traditionally three separate closings:

- close on the land for cash with equity investors

- close on a loan with a construction lender

- close on the sale of the property to a long term, passive investor once it is built and stabilized

Currently seeking opportunities to invest in compelling development or redevelopment projects including:

- Retail

- Office

- Industrial / warehouse

- Municipal

- Student housing

- Special use properties (data centers, gas stations, convenience stores, refrigerated storage, etc.)

- Renewable energy with power purchase agreements (wind, solar, geothermal, biomass, etc.)

- Tenant improvement programs / green renovations

According to Repka,

"The best fit is a project sponsored by an experienced development team that builds single tenant or 'easy to understand' multi-tenant projects with tenants we like."

Bison is focused on single transactions over $10 million or aggregation opportunities to build "cookie cuttter" projects with the same tenant and development team. A basic guideline for tenant quality is tenants rated BBB- or better by Standard & Poors, but private, well-capitalized companies without public credit ratings will be considered on a case by case basis.

Since the financial viability of the project is established by the credit quality of the tenant(s), not the developer, this is the perfect program for a developer that has magnificent industry contacts and connections, but has had their credit trashed by the downturn. Banks and LifeCos are typically not willing to overlook the battle scars and bruises to a Developer's credit, Bison's investors will.

The meticulous focus on risk reduction in this model gives a long-term investor comfort to back this type of developer. Bison is also seeing deal flow from developers at the early stages of their careers because the traditional conventional lending model is that a developer needs a net worth two times the project size to qualify for funding. That means a $80 million net worth requirement to do a $40 million project. "Since our investor is the ultimate owner of the project we don't have to live in that restrictive box", quipped Repka.

The evaporation of national sources of construction funding created a void that needs to be filled.

The Nexus Funding Platform created by Bison Financial Group is a positive step in that direction. We look forward to getting Americans back to work.