If you're keeping up with current events, you may have heard talk of a potential recession on the horizon. And if you're a real estate investor, you may be wondering: is commercial real estate still a good investment during an economic downturn?

The short answer is... it depends.

While recessions can certainly pose challenges to real estate investors, there are still opportunities to be found in the market. In this conversation, we'll explore the question in more depth and provide some insights on how you can make the most of a potentially turbulent market.

First, it's important to understand that not all commercial real estate sectors are created equal when it comes to recessions. Some sectors, such as office and retail, are often hit harder than others. For example, if companies are downsizing or going out of business, office space may become vacant and retail businesses may struggle to make sales. On the other hand, sectors like industrial, self-storage, and multi-family housing may continue to perform well during a recession.

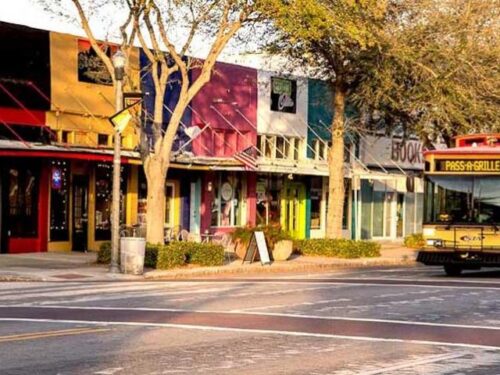

But even within a particular sector, there are factors that can impact the performance of individual properties. Location, for instance, can play a big role. Properties located in areas with strong job markets and economic stability (think Florida, Texas, and Arizona) may be better positioned to weather a recession than those in more volatile regions (New York, Michigan, Illinois, etc.).

So, what can you do as an investor to make the most of the current market conditions? Here are a few strategies to consider:

Diversify your portfolio:

Rather than putting all your eggs in one basket, consider investing in a variety of commercial real estate sectors and locations. This can help to spread your risk and minimize the impact of any one property or sector experiencing a downturn.

Look for distressed properties:

During a recession, some property owners may be struggling to make their mortgage payments and could be looking to sell their properties quickly. These distressed properties may offer opportunities for investors to purchase at a discounted price and turn a profit once the market rebounds.

Focus on long-term investments:

While it may be tempting to try and flip properties quickly for a profit, during a recession it may be more prudent to focus on long-term investments. By purchasing properties that are likely to appreciate in value over time, you can weather short-term market fluctuations and ultimately come out ahead.

Consider alternative financing options:

If traditional lenders are tightening their belts during a recession, you may need to get creative when it comes to financing your investments. Consider options like crowdfunding or private lenders to help you secure the funding you need.

Work with a knowledgeable real estate broker:

During a recession, having a real estate broker who understands the market and can help you navigate potential pitfalls is more important than ever. Look for a broker with experience in commercial real estate and a track record of success during challenging market conditions.

In summary, while a recession can certainly pose challenges for commercial real estate investors, there are still opportunities to be found in the market. By diversifying your portfolio, focusing on long-term investments, and working with a knowledgeable real estate broker, you can position yourself for success even in the most uncertain economic times. So don't let the fear of a potential recession hold you back from pursuing your real estate investment goals. It has often been said that the best time to buy real estate is today!

Author: Jared Repka

About the Author:

Jared Repka is the Co-Founder of Bison Financial Group in St. Petersburg, FL.

Bison arranges debt and equity financing for commercial real estate investors and developers.

Bison has relationships with investors across the risk spectrum funding acquisitions, renovations, and new construction.

Click to learn more about:

Bison Financial Group