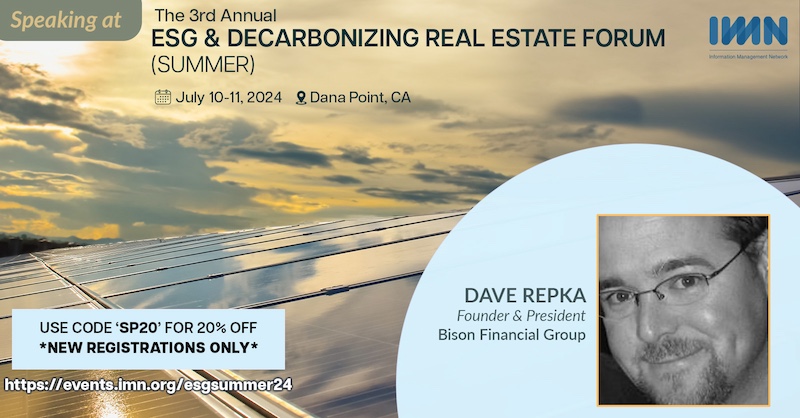

Bison co-founder, David Repka, will be speaking at IMN’s ESG & Decarbonizing Real Estate Forum on July 10-11 in Dana Pt, CA. This conference is the essential gathering for ESG & sustainability professionals, investors, operators, property management firms, lenders, technology/service Read More

Category: Capital Markets

Navigate the Fine Print: 10 Critical Items You Must Review in Your Commercial Real Estate Lease Agreements

Introduction: Entering into a commercial real estate lease agreement is a significant milestone for both landlords and tenants. However, amidst the excitement of securing a space for business operations, it’s crucial not to overlook the importance of thoroughly reviewing the Read More

10 Strategies to Recession-Proof Your Commercial Real Estate Investment Portfolio

In the unpredictable landscape of the real estate market, economic downturns are an inevitable reality. However, savvy commercial real estate investors understand that proactive measures can be taken to mitigate the impact of recessions on their investment portfolios. By implementing Read More

The 10 Burning Topics Commercial Real Estate Investors Lose Sleep Over

Sometimes investing in Commercial Real Estate is a tightrope walk over shark-infested waters. An investor must balance the potential for lucrative returns with the myriad of risks that come with the territory. From navigating fluctuating market trends to managing tenant Read More

The Importance of Financial Analysis for Commercial Real Estate Investors

In the fast-paced world of commercial real estate investment, success often relies on the adept navigation of complex financial waters. Much like skilled sailors charting their course through turbulent seas, investors must navigate with precision, balancing the currents of risk Read More

How to Elevate Your Funding Request to the Top of an Investor’s Stack of Potential Deals

In today’s dynamic financial landscape, securing funding for real estate projects requires strategic planning and a keen understanding of investor priorities. With markets constantly evolving, it’s essential to stay ahead of the curve to maximize your chances of standing out Read More

Bison gets asked, “If we are entering a recession, is commercial real estate still a good investment?”

If you’re keeping up with current events, you may have heard talk of a potential recession on the horizon. And if you’re a real estate investor, you may be wondering: is commercial real estate still a good investment during an Read More

Securing Financing for Your Commercial Property Purchase: 5 Steps You Need to Take Now!

As a real estate investor, the thought of purchasing a commercial property can be an exciting (and intimidating) prospect. However, before you can make your investment dream a reality, you must consider one critical aspect of the deal – financing. Read More

Crittenden CRE Finance Conference Highlights: Key Takeaways and Insights – Part 2 of 2

The author recently attended the Crittenden commercial real estate finance conference in Miami Beach which brought together industry experts and professionals, providing valuable insights into the current trends and challenges in the market. Here’s a comprehensive summary of the next Read More

Crittenden CRE Finance Conference Highlights: Key Takeaways and Insights – Part 1 of 2

The author attended the recent Crittenden commercial real estate finance conference in Miami Beach which brought together industry experts and professionals, providing valuable insights into the current trends and challenges in the market. Here’s Part 1 of 2 with a Read More