As a real estate investor, it’s important to always keep your eye on the endgame: the exit strategy. While it may seem counterintuitive to think about selling your property before you even buy it, having a well-defined exit strategy is Read More

Blog

Maximizing Your Investment: 7 Critical Steps to Determine a Commercial Property’s Current and Projected ROI

Investing in commercial real estate can be a lucrative opportunity, but it’s important to ensure you’re making a wise investment. One of the key factors in determining the viability of a commercial property investment is the return on investment (ROI). Read More

The 5 Critical Items You Must Review in Your Commercial Real Estate Lease Agreements

Commercial real estate lease agreements can be complex, and it’s easy to overlook critical details that can impact your investment. As a landlord, it’s essential to review your current lease agreements and understand any upcoming renewals or expirations. In this Read More

The High-Risk Game of STNL Investments: Are You Prepared to Take on These Hidden Risks?

by David Repka Single tenant net lease (STNL) investment is a popular strategy among commercial real estate investors. It offers a low-risk, long-term investment opportunity with steady cash flow and minimal management responsibilities. However, like any investment, STNL investment comes Read More

5 Things You Absolutely Can’t Ignore When Buying Commercial Real Estate (#3 Will Shock You!)

by David Repka Are you looking to invest in commercial real estate? Congratulations! You’re about to embark on an exciting journey that can yield great rewards. But before you get too excited, there are some critical factors you need to Read More

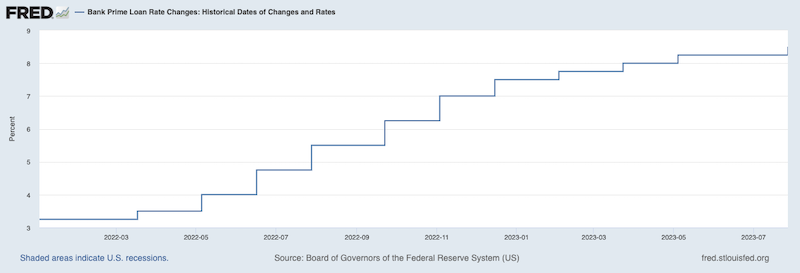

Interest Rates Skyrocketed 3X in 18 Months! Discover the Top 10 Challenges Plaguing CRE Investors Now

by David Repka Prime Rate has risen from 3.25% in January 2022 to 8.5%. What problems does this create for commercial real estate investors? And what steps should be taken? Rising Cost of Borrowing: With Prime interest rate nearly tripling, Read More

The Ultimate Guide to Projecting Cash Flow in Commercial Real Estate: 5 Steps You Need to Know

by David Repka and Cameron Rinaldi When investing in commercial real estate, it’s essential to project the property’s potential cash flow accurately. Cash flow projections are crucial for determining the property’s profitability and making informed investment decisions. In this post, Read More

10 Key Insights from the IMN Conference in Newport, RI: A Must-Read for Commercial Real Estate Professionals

by David Repka Are you involved in the commercial real estate industry? Are you looking to stay ahead of the game and make informed decisions? I’ve got you covered! I’m David Repka, co-founder of Bison Financial Group in St. Petersburg, Read More

The Negative Leverage Conundrum: Navigating the Challenges of Commercial Real Estate Investing

by David Repka and Lindsay Rapuano In the world of commercial real estate investing, the concept of leverage has long been a key driver of returns. By utilizing low-cost borrowed capital, investors and developers could amplify their potential gains. However, Read More

The Ascendancy of Family Offices in Commercial Real Estate: Unveiling the Key Factors Shaping Investment Decisions

by David Repka In the dynamic realm of commercial real estate, a powerful player has emerged, wielding substantial financial clout and redefining the landscape of investments. Enter the family office—an exclusive institution established by affluent families to manage their wealth Read More